Diversifying your Sources of Income as an Entrepreneur is a Guarantee of Success

- Jorge Diaz

- Jan 5, 2022

- 5 min read

Updated: Oct 16, 2023

One of the most important parts of being an entrepreneur is having the ability to diversify your sources of income. Just by not being attached to a payroll or a steady source of income, you are exposed (at least from your human resources point of view) to losing it all suddenly.

Not the specific case, but I remember a chat I recently had with a friend who works at Meta (formerly Facebook) who decided to unload most of his $FB stocks due to the fact that, as he works at the same company, he is highly exposed to it. Just imagine the unlikely scenario that the company goes through a tough period: he would likely lose both his job and a major part of his portfolio. Both his "human capital" and his "net worth" would be severely hit.

The same goes with entrepreneurs: you need to diversify your resources (including your human capital) for the sake of safety and stability. No one ever knows what the future prepares for us, so it is always a good idea to be as diversified as possible.

Capital Allocation Alternatives

Back when the COVID19 pandemic began, I wrote an article about how diversification helped my business stay afloat during that tough period. I also wrote an additional one regarding how the crisis impacted my personal finances while diversification also played a key role in keeping our family finances in check.

The purpose of this article is to serve you as a guide on where to look for. This is the first, easiest and fastest way of diversifying your resources: allocating these on the capital market.

Capital markets have been for centuries, the easiest way of allocating resources into companies, businesses and entities that tend to operate with the intention of serving society and generating a profit from it. From a simple point of view: it is where you can buy a piece of a company and experience the full benefits of the ownership. It comes with all the perks and responsibilities of owning a fraction of a business: you receive dividends regularly, and your asset value may grow over time (and also decrease). Plus, if you have a big chunk of it, you have the right to vote, although this is really difficult to occur unless you were an initial shareholder. Take of reference that at the moment of writing this article:

Elon Musk owns ~17% of Tesla shares

Jeff Bezos owns ~10% of Amazon shares.

Bill Gates owns ~ 2% of Microsoft shares.

Chances are both you and I will never own a voting part of a public company unless you found one and later do an IPO into the capital markets. Who knows! ;) For sure you are either 100% or a big chunk owner of your current business, which is already great!

So, and to separate it into two cases:

if you are an entrepreneur and you only have your business, then you are 100% exposed to how your business performs in the future.

if you are an entrepreneur and a portion (let's say half) of your capital is allocated into your business and the other half is allocated into the capital markets, your future depends on 50% of your business and 50% of the businesses that you own but other people operate.

The point is that you would be diversified and the outcome of your business (or the capital market) will be only half responsible for what happens next. Please note that I'm mentioning a 50/50 allocation as an example, which definitely doesn't mean it needs to be that way.

Capital Markets Growth over Time

It is popularly known that the U.S. stock market tends to grow on an average of 9% per year. I remember a few months ago when a user at the Rational Reminder community, asked a question regarding "why capital markets always tend to go up? Does the consistent upward trend mean that people systematically underestimate future earnings and keep being positively surprised?" and I replied:

Capital Markets are probably one of the main indicators of how progress happens (you can scale it up from a single company stock all the way up to the entire human civilization).

So, the current “market” prices include all possible public knowledge of how fast will progress occur, including speed, scale, environment, social… you name it. It is all in a consensus embedded in that price.

If progress happens earlier than expected, yes. Prices will go even up. If something shakes our civilization, such as a pandemic, the financial system collapse or a world war, yes, it will slow down too.

Regarding that people "continue to be positively surprised" Yes, that is correct. We tend to remain realistic but we are regularly surprised of how fast mankind can progress.

Although my intention is not to provide any specific financial advice, I strongly encourage you to evaluate allocating your resources towards a diversified capital allocation asset such as an ETF. It could be either U.S. stock market, emerging, European or Canadian, but something as diversified as possible.

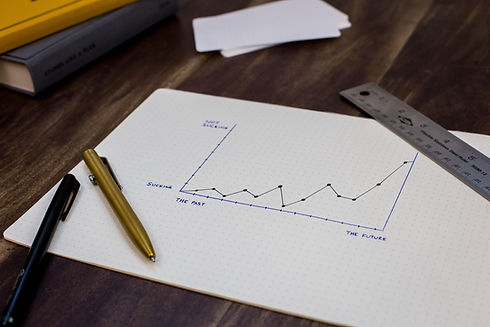

Diversification over Time

As years come by and our human resources start to deplete and become more limited, our allocation should tend towards reducing our exposure to it and increasing it into the capital market side. This way, we can switch from being a full-time self-employed entrepreneur to a part-time and later a retired one.

If I were to break it down into a 35 years work life, I would summarize it as follows:

The early 20's: 100% Human Resources | 0% Capital Resources.

Mid 20's - 30's: 80% Human Resources | 20% Capital Resources.

Early 30's - 40's: 60% Human Resources | 40% Capital Resources.

Early 40's - 45's: 40% Human Resources | 60% Capital Resources.

Early 45's - 50's: 20% Human Resources | 80% Capital Resources.

50's - Retirement: 10% Human Resources | 90% Capital Resources.

Retirement: 0% Human Resources | 100% Capital Resources.

Waiting to be retired or at a late stage in life to start allocating our resources to the Capital Market side comes with a serious and expensive lesson: we either diversify early in life or we will work until the end of it.

As entrepreneurs, it is always hard to realize the importance of understanding that the future of our businesses or services is mainly out of our control. Uncertainty is the only certain thing about the future.

Stay safe and diversified!

How to Stay In Touch

Every week I publish book recommendations from books I read on my Instagram account. You can also subscribe to the leantrepreneurship.com mailing list to receive updates from this website. I have recently started a collaboration with the Florida Energy Bill Trimmers, so you can find me there too.

New To Investing?

If you are in Canada and are looking for ways to grow your wealth, you should start by opening an account at Questrade Inc. and begin investing your money. It is the #1, most prestigious and most affordable brokerage in Canada. By following this link, you will get a cash bonus, up to $250, depending on the amount you deposit when you open/transfer your TFSA, RRSP, RESP or brokerage account.

Comments