The Value of Diversification: Personal Finances & Net Worth

- Jorge Diaz

- Apr 10, 2020

- 4 min read

Updated: Apr 21, 2021

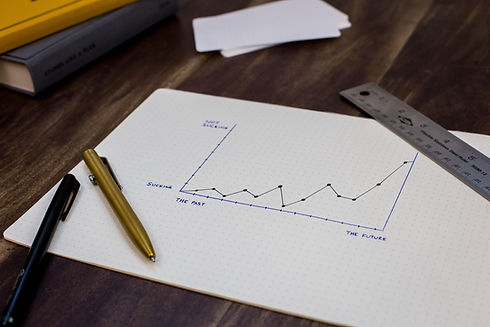

Either for your own personal long term investment, retirement savings and even for active traders, diversification strategies are well known to be safe. But I won't refer to daily trading here, I'm completely at 0 on that and, up to this point, I have no interest in it.

Having a solid personal diversification strategy comes very handy during these crises and pays off in the long run. Just to mention an example: the decision of laying off myself, as crucial it is for avoiding the business to go under the red line, it is an insurance that I can save both of us for a while. Having an immediate need for generating cash flow to cover family needs may be the thin difference of defaulting or just cover the minimal operation costs.

Personal Savings/Net Worth

One of the most important parts of my personal net worth is my Emergency Fund. An emergency fund is like a mini parachute you bring with you everywhere. Just 3 months ago, and without the most minimal idea this crisis was coming, I wrote an article about the importance of a cash reserve. I've been a big advocate of it during my whole adult life and even more when my family started to grow.

During the March 2020 market crash due to the international COVID-19 situation, my personal portfolio got hit by the fall, like any other in the world. Still, the diversification strategy managed to reduce the impact on my short term plans to face unexpected situations.

My cash reserve will be, for months to come, the place where I'll be making decisions. These will be carefully taught, analyzed and if I make a mistake, it won't be because "I was in a rush".

An emergency fund is like a mini parachute you bring with you everywhere.

The "Future Me" Diversification

The Emergency Fund is playing his role now but, how about the rest? Well, for sure you don't want to put everything on a regular savings account. Somehow, you need to keep up the pace with inflation and compound your savings a little bit.

The green and yellow parts of the previous pies are essentially Exchange-Traded Funds or ETF. These kinds of products hold assets like company stock, commodities, and bonds and can be easily bought and sold using any brokerage. There are one of the most popular investment vehicles over the past 50 years and are my #1 pick when it comes to long term investment. The ETF investment has proven to be one of the most solid investment strategies over the past 100 years, for example, as the U.S. market.

It is well known that companies make it to the top 500 in the U.S. stock market for an average lifespan of 15 years. This means that if you are looking for a 20 or 30 years time span for investment, putting all your eggs into a single basket could seriously hurt you in the long run. And this is one of the main reasons John C. Bogle, founder of Vanguard, suggests investing in ETF: the low-cost portfolio diversification. It means that, if you buy a product that "holds a little and proportionate piece" of each one of those 500 companies, you are essentially investing in the U.S. companies in the long run.

...companies make it to the top 500 in the U.S. stock market for an average lifespan of 15 years.

During the past 50 years, $1,000 invested in the top 500 United States companies (proportionally and as a whole), would have compounded at a yearly rate of 9%. This means the thousand dollars would have ended up at $74,357.52. Yes, every dollar would have multiplied itself for 74.35 times. It is a long time, I know. But it is worth the wait.

Now, this is not something you do inside a regular savings account. You need to do it on a specific kind of account, with some specific trading features... but to keep things simple, I'll refer to the most popular ones here in #theNorth.

In Canada, registered savings accounts such as the Tax-Free Savings Account or TFSA (U.S. Roth IRA), and the Registered Retirement Savings Plan, known as RRSP (U.S. IRA) are very popular to be invested in long term ETF products. Within these accounts, money grows "tax-free" although it is treated differently when it is withdrawn.

Now, what you can buy inside these accounts? Anything, from stocks like Coca Cola(KO), Air Canada(AC) or any publicly traded company to commodities like gold, silver, and oil.

But, as I said, I prefer ETF.

iShares Core S&P 500 ETF IVV is one of the most popular diversified products to invest in for the long run. It offers an incredible capacity of diversification across more than 500 holdings it includes.

During the crisis, while some companies have lost more than 90% of their market value, holding a wide-spread of companies shields my future investment to have only lost 28%. And seeing between 50% - 70% of my portfolio "available", is something I can live within the next few months. I don't plan to retire anytime soon.

Career Path Diversification

Diversification applies to personal development also. I have honestly never thought about it until a good friend of mine once told me:

"I would never buy Microsoft shares (NASDAQ: MSFT) because I have dedicated the last 8 years of my computer sciences degree to work and develop my skills with Microsoft Azure" (the Cloud Computing service). "I have invested my personal development career into Microsoft, so I have to hedge my financial resources elsewhere to remain diversified. If Microsoft technology succeeds in the long run, I'll have way more work. If it doesn't, I will have my portfolio."

That was probably one of the most brilliant things I've heard in my life and has for sure inspired me to dig further and better understand the value of diversification up to that level.

New To Investing?

If you are in Canada and are looking for ways to grow your wealth, you should start by opening an account at Questrade Inc. and begin investing your money. It is the #1, most prestigious and most affordable brokerage in Canada. By following this link, you will get a cash bonus, up to $250, depending on the amount you deposit when you open/transfer your TFSA, RRSP, RESP or brokerage account.

Comments