The Value of Diversification: Building a Recession-Proof Business

- Jorge Diaz

- Apr 10, 2020

- 8 min read

We are all going through very difficult and unprecedented times: the coronavirus pandemic. Besides the devastating health impact, on the economic side, the COVID-19 situation is shutting down entire industries, stock markets and taking a huge toll across small businesses all across the globe.

My company, like all others, has been impacted too. There is no way it could have not received the shockwave this situation has created among our Canadian customers:

A huge Traffic drop: About 60% of exposure and near 80% of purchase interest.

A critical revenue drop: About 70% of regular operations and 100% for some services/products.

A worried customer-base who approaches services with obvious fears regarding the end result of our products.

Our cash reserves are not enough to cover the previous rhythm of operations + wages + third party services.

I had to layoff myself temporarily in order to allow my colleagues to continue working, even with a salary reduction.

Many of our B2B clients had to temporarily suspend their contracts due to a lack of resources, availability, and government regulations in place to reduce the impact of the pandemic.

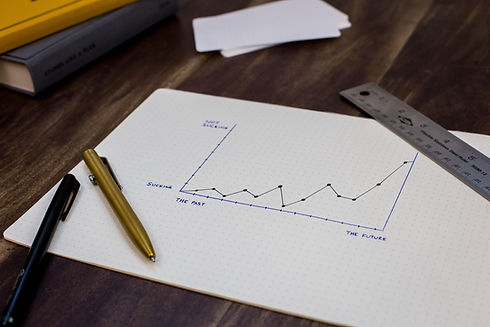

But there is one key aspect that is keeping my business alive during a moment like this one: Diversification. LeaseCosts is still alive because we build it with a specific mindset (not that we knew this was coming, for sure) No one can predict the future, but everyone has the capacity and the opportunity to prepare for it.

According to the Oxford encyclopedia, "diversification"(on business context) is known as the process of a business enlarging or varying its range of products or field of operation. It is a process, like any other during a startup development track and should be considered as seriously as your main company objective itself.

Just to give you an easy example: diversification means that if you manufacture headphones, while time passes by you have to (or at least plan to, eventually) bring different models into the market. Evaluate what side-products and services you can "attach" to your portfolios such as batteries, Bluetooth speakers and color variants. Model upgrades are also considered diversification efforts, as so is to follow-up on market trends or competitors' benchmark. Even having multiple manufacturing locations is also diversification and even looking for different retailers to deliver your products to the customer's eyes.

In a previous article about rescuing an online business during an economic crisis, I mentioned that:

Diversification has been key for the businesses I've built over the past decade, for my investment portfolios, and even for my personal career. I will talk about this in a future article.

Well, this is that future article:

Diversification on Startups/Small Businesses

Small businesses need to be built using a diversification mindset. Being completely closed to a specific context, idea or scenario has resulted in some of the biggest disasters in history.

If you do not believe me, go ahead and do a Google search for Kodak, Blockbuster, Nokia...

And if it has happened to big corporations, it occurs even more on small businesses/startups. Diversification, although not part of the initial stage, should be always taken into consideration after the main business idea is starting to get traction. As soon as sales start to happen, diversification talks should begin in the board meetings (even if these occur inside one head).

Diversification should occur within a Startup organization ideally after the core product/service proves itself to generate market traction.

Now, how to specifically apply this, is a separate topic I will discuss in the following section. But you should know that if you are already beyond the "Traction Stage", you are late. Let's begin:

Service Diversification

Although I'm not pretty sure if I should talk first about Service or Product, I'll go straight to the one I have more experience with: how to diversify your services.

If you have read any of my other articles, you will notice I like to explain some concepts using examples:

Expand your services to more audiences: Most service ideas are born because of a custom service provided to one specific customer. You were "bringing groceries", "driving for errands" or simply "doing SEO" for one specific person. If suddenly the need drops, you are out of business. Bring your service to more customers in your area, your network of contacts or simply list it on an online classified website. It will shield your venture from falling apart because it was hanging from a single rope.

Extend your service portfolio: This is the first thing that comes to mind when you hear the word diversification. It is obvious and easier to relate to. In most cases, services can be "personalized" or adapted to multiple other scenarios and then, a new service is born. Be open to evaluating small upgrades or tweaks that can eventually show up as a fresh/new business opportunity within your portfolio.

Point towards the opposite direction: Yes, put your feet on the ground and be realistic. What will happen it all the services I provide, suddenly fall apart? What would be the thing we can also offer, but that will be completely unrelated to our current services and still, help us thrive under a situation like this one? Are we a B2B company but should we also consider providing some B2C services? This is probably the toughest tip, but it could help you save big on moments like a crisis. I've been there. Looking at the same direction we were 4 years ago and I would be already looking for bankruptcy lawyers.

Diversify your workforce strengths: If your business is built all around you, there is a significant risk. One day you fall sick or somehow are unable to work, and all operations go down to zero. Bring employees who cal help you build your project and motivate them fairly. On many occasions, they will be the ones who will fight as you to keep it alive. I love the "lone wolf" idea, but it is riskier as you will only believe the day you get there.

Going back to my context: during the traction phase of LeaseCosts, we were able to provide services to five major B2B customers. It helped us grow strongly while continuously gaining speed, reach, and deliver more value to the website visitors. Then, at some point, we strategically decided to incorporate B2C services, and extend the corporate portfolio to two other Canadian based companies. Not that we needed to, but we definitely had to, in order to keep on.

Now, during the 2020 COVID-19 situation, and with most operations severely impacted, the recurrent diversification strategy has helped us keep the business afloat. And with our current setup, it can continue to thrive for years to come.

Product Diversification

But way before LeaseCosts, one of the first businesses I launched, almost 10 years ago, was a "product-based" service. We were selling digital goods for a variety of industry sectors: real estate, vehicle retailers, online commerce, digital press, and marketing agencies. One way or the other, sales were completely unpredictable, but the portfolio was diversified enough to maintain a solid and recurrent cash inflow.

Nowadays, if I had (or were launching) a product-based business, I would start diversifying it by applying the following ideas:

Creating product variants that can fit into related audiences/industry sectors: If you sell vegetables, then get more variety for your customers. If you are a musician, release albums with more than 10 songs, but no more than 18. Don't go straight to one single offer: multiply whatever your idea is with similar alternatives that help you offer a diverse set of products.

Bringing products to new markets: Some audiences are easier to sell and, most of the time, results in a more profitable opportunity (due to the increase of delivered value) than creating additional product variants. Testing your product across new reachable markets is often a good measure of how deep you could go. There is nothing more veridic than bringing something to potential audiences and asking for feedback. Customers know what they want, where, when and how. Once you know it, you own your near future.

Diversifying production & distribution chains: While it is more a "crisis" kind of approach, looking for multiple manufacturing structures and transport alternatives might surprise you. I would never wait for a crisis to do so, at least to scope alternatives twice a year. It could mean, in multiple scenarios, the difference between profitability and loss. Having the right providers and factories behind you is a solid foundation, but it doesn't usually happen on day 1. And when I mean factories, I also mean kiosks, 3D-printers, material providers and so on, no matter the business type.

Developing/Acquiring related products: I like to compare acquisitions to time-machine travel: these occur by hundreds every day across the globe and are one of the fastest ways to buy time, the most valuable asset ever. When you acquire a company, you are instantly acquiring a diversified organism that is capable of providing value, self-maintain and has a history to tell. Attaching it to an existing organization (either by a merger or as a sub-entity) is one of the fastest diversification strategies ever.

Resource Diversification

Resource management is the third and most important part of a business. It is where all the harmony occurs within an organization and we could say it is "the physical" part of a business entity. The things you can youch, the things you can see and the people who take care of making it all work.

When it comes to resources, you can start diversifying your business by:

Balancing cash reserves, debt, and line of credit availability: Although I'm a big advocate of using debt leverage to speed up traction stages, cash reserves should be also considered to be part of the business assets. Applying the Profit First system combined with a Line of Credit has helped us to have a clear and balanced asset distribution strategy. During this correction, we have paid all our outstanding debt balances with the cash reserve and have redistributed the allocation to be aligned to the situation: 0 debt, 0 interest expense, and a "long-term worst-case scenario liquid" cash reserve. Love the 6-word thing, but basically it is our contingency plan and we are proud it is sitting there.

Having available backups for critical assets: Make sure operations continue, even at a slow pace, if something occurs. Either a market crash, a meteorologic event, or a key employee positions quit, these situations can easily compromise the operations of your company. For websites, make sure to have full backups in different physical locations. It could be your computer + a cloud drive + a USB resource. For physical manufacturing machinery, make sure to have access to a backup one, or at least an old version that could be brought in to continue production during a slowdown or a malfunction.

Preparing your employees/colleagues to play key emergency roles: Your employees should always be prepared to wear "emergency hats", and you should be the first one. Human resources are one of the biggest assets a company have and, obviously, most businesses rely on people to deliver value. You need to be able to temporarily replace anyone and the responsibility spreads all the way down through managers.

On the Personal Side

Having a solid personal diversification strategy comes very handy during these crises and pays off in the long run. The decision of laying off myself, as crucial it is for avoiding the business to get into a red line, it is an insurance that I can save both of us for a while. Having an immediate need for generating cash flow to cover family needs may be the thin difference of defaulting or just cover the minimal operation costs.

I will refer to it in a future article, where I will describe how diversification plays when it comes to personal finances.

Main Takeaways

While it is not an exact science, launching startups take a lot of "right decision making" from day one. Lots of execution, evaluation, analysis, and correction... again and again and again. Well, now add "some diversification" to it. Not sure where, but keep it in mind, you will regret not having done so in the long run.

It is a must for startups, business ventures, and big corporations. Otherwise, we would have been out of business, not now during this crisis, but way before it occurred. It is a "lifelong" contingency plan that is continuously running while making sure you are able to overcome the most difficult situations.

Like a market crash.

New To Investing?

If you are in Canada and are looking for ways to grow your wealth, you should start by opening an account at Questrade Inc. and begin investing your money. It is the #1, most prestigious and most affordable brokerage in Canada. By following this link, you will get a cash bonus, up to $250, depending on the amount you deposit when you open/transfer your TFSA, RRSP, RESP or brokerage account.

Hashtags

#entrepreneurship #entrepreneurbooks #entrepreneur #bookstagram #inspiration #business #businessideas #selfhelpbooks #books #businessbooks #businessbook #businessdevelopment #startupbusiness #startupbook

Comments