Stock Markets are Crashing. What Should I Do?

- Jorge Diaz

- Mar 23, 2020

- 2 min read

Updated: Mar 30, 2020

First of all: stay home. That is the #1 thing. This is a war. We are all battling against a nasty virus, and there is only one way to win it: Staying home. It is disruptive, it is painful, it is economically hard, but it is the only way. It is the ONLY WAY. We need to take care of the elderly the same way they would be taking care of us if the age of risk were the opposite as it is right now. People are dying, health care systems are overflowed, and this is the only thing we all have to do: stay home for humankind.

#1 Stay Home

So, if you are staying at home, you have accomplished step #1. Thank you.

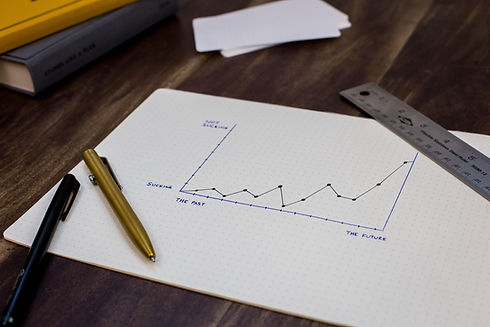

#2 Understand the Narrative

The COVID19 pandemic is the reason why markets are going down. News, media, governments, and social media are full of facts, reality, and the huge wave.

The DOW, S&P, and most individual stocks everywhere in the world have dropped between 10% - 90% over the last four weeks. Still, all assets are there, but just standing. Just to mention an example: Air Canada has all airplanes on the ground, call centers are empty, most crews and pilots were temporarily laid off. Air Canada stocks dropped from 55CAD back in December to only 12. The travel industry is probably one of the most affected economically with the virus, but it is happening everywhere.

You need now to rely on your emergency fund. If you cannot work remotely, stick to it, apply for Employment Insurance and evaluate your options from home.

# 3 Follow Your Rules

Simply follow your rules. Do whatever you would have done if there was no crisis. But don't believe me, I'm not a financial advisor., but Ben is. Who better to explain it than Ben Felix:

Once again. To deal with the current Market Crash:

#1 Stay Home.

#2 Understand what is Going On.

#3 Stick to your Plan.

Stay safe!

Comments