Startup Funding in Canada: Getting traction with a Line of Credit

- Jorge Diaz

- Nov 26, 2019

- 7 min read

Updated: Nov 29, 2019

Last weekend I was having a chat with a close friend who is an Olympic medallist in weightlifting. Yes, the guy has a medal from London 2012 and lots of people (thousands, including me) are very proud of him. Now, the funny thing about that is that he has always been an entrepreneur. His active athlete career was simply his most successful venture: worldwide reach, traveled the entire globe and reached an amazing milestone. It is how he always has seemed life and it is how it always will be for him.

Although he closed that chapter of his life already, he just can't stop pursuing his dreams. The next one: opening a weightlifting gym.

Gyms are among the most popular business athletes open after retiring from the active competition life. The experience, amount of knowledge and value these can bring to the aspiring and amateur athletes is highly appreciated and with a high demand around the world.

So, while there are hundreds of topics I could bring here about my talks with Ivan, this post will be specifically dedicated to the "funding" part of the discussion we had.

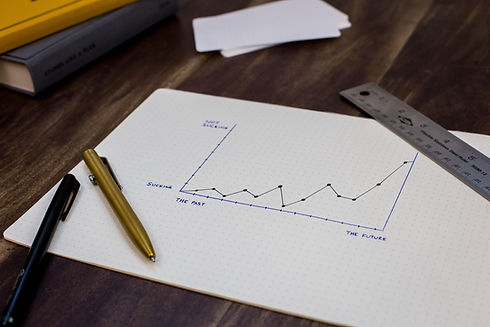

The "Debt Management" Muscle

Ivan's gym will be his Canadian startup. A startup he will need to fund as any other business venture in the world. He needs to lease a place to run it, buy equipment and spend time actively working with your clients. So funds are a must in his case, at least at the very beginning.

Sweat equity will also play a key role here. He will need to test the waters, take care of the first clients, build up the client base and operate his business at the same time. The good thing is that he had already passed the testing part: he has a list full of interested people who wants to jump into his gym once it is open to the public. He currently trains them at different gyms, so he has a very clear picture of what an MVP (Minimum Viable Product) or "base gym" setup he needs to start.

Essentially, and going back to the meat here: he needs funds. His next step is to secure the funding required to acquire all the assets he needs to set up his MVP gym. He has considered partnering with someone, a loan, a line of credit... and although those all variables are entirely viable, my advice was to start flexing his "debt management" muscle and start with a Line of Credit.

"The Value of Debt" from Thomas J. Anderson is one of the best reads you can find to understand how important is the leverage debt can bring to the table on multiple scenarios. Including a startup.

Why a Line of Credit and not a Business Loan?

The loan is money that comes into your pocket instantly. You own 100% of it and also have the instant liability of returning it back on a fixed payment for an agreed period of time. Making the payments or installments (returning it) is a must. Not doing so, generally results in a penalty and a hard credit hit, so it is never a good idea to miss one, so banks will usually set up pre-authorized debits from your chequing account to avoid this scenario.

So I will use an example scenario to describe how it works:

Let's assume you are starting a new online store and need to purchase some $5,000 worth of inventory. On Ivan's specific case, buying $5,000 worth of gym stuff. Weights, discs, benches and so on.

The investment is right straight and from the very beginning, so you will have to use it all (or most of it) as it makes no sense to leave it in the account. Payments will be debited from your account you use it or not. If somehow your MVP fails, you will still have to continue paying, maybe even selling assets to afford the payments.

Business loans are mainly beneficial when you have already some sort of cash flow into your business operations. This means that your business generates positive cash flow and, at some point, your loan can be assumed as an additional expense that won't be covered by the loan investment itself. Loans are ideal for mid/late startup stages, but not for the very early ones. Here is an example:

Your gym membership is generating a recurring monthly net revenue of $1,000. After paying the lease, your salary and all operating costs, you have an extra thousand dollars in your pocket of pure earnings. If you jump into a loan for upgrading your equipment that will be paid back at $300 per month, your net earnings would then be at $700 per month, but you will be investing in the opportunity of increasing it due to the loan purpose. Worst case scenario, if your investment fails, your current cash flow will still be able to pay the installments, and your investment risk ends up reduced and under your control.

But usually, that's not the case when you are at the very beginning of your project. Your cashflow is literally 0 on day one. Even if your clients are waiting for you to start.

The Line of Credit "Muscle"

A Line of Credit (LOC) is very similar to a Credit Card. You take money out of it and then, you pay interest based on how much you owe every month. If you don't take any money out, you pay nothing. There is no literal obligation to pay every month, although every interest payment is "taken" from the LOC itself. This means that, if you owe $10,000 and there is an interest charge of $80, next month you will owe $10,080. You can find a very nice comparison between LOC and Loans on the Canada.ca Government website.

LOC can be found mainly in two types:

A Separate Account: It is an additional account where you can transfer money from/to other accounts in your business. It is like any other account with a "fund availability"(up to your credit limits) that you can use anytime to move funds around all your accounts. If your credit limit is $30,000 and you withdraw $10,000 for buying pieces of equipment, you will then pay interest on the 10K and the balance of the account will be the $10,000.

An Overdraft on an Existing Chequing Account: This is one of the ideal accounts and the one I always recommend for business owners. Following the same sample previously mentioned, if you have a $30K credit limit, you can withdraw or pay with cheques from that account and it will go negative. If you have $4,000 dollars in the account and make a payment of $10,000 in equipment, your balance will go to -$6,000 and you will pay interest then on the $6K used from the overdraft. On later posts, I will talk more about how this setup works with the Profit First approach.

The Profit First method works amazingly together with a LOC as an overdraft protection on a chequing account. Set it up on the operations account and you are all set to go. I'll discuss it in more detail on a future post.

The idea with the LOC is that you use debt accordingly to your startup growth. Although most Business LOC can go up to $50,000, I would always recommend starting with a way lower one.

The Initial LOC Allowance

I always suggest beginning with a $5,000 - $15,000 LOC when starting up a business, even if you have the funds available elsewhere. During the first months, if the business is proven to operate among those limits and starts getting traction, then you can go further and request more availability, depending on your operating cash flow. This way, if you are a fresh entrepreneur, it will help you develop your debt muscle within a safe environment. On the other hand, if you are more experienced, it will still keep your mindset under controlled limits and will help you bootstrap your business carefully.

Then, after a few months of operations, you can evaluate how risky it is to expand or not and bring it on to a higher level. But always start small or accordingly to your expected operating cashflow.

Now that you have a raw idea, let's talk about where you can actually set up your LOC in Canada. The ideal answer is in the bank where you have your business accounts. Still, if you are starting from scratch, here are some good alternatives to take a look at:

TD Canada Trust Small Business Line of Credit

I've always been with TD, both for my personal finances and my business accounts. They have a product called Small Business Line of Credit that allows business owners to get up to $50,000 of available credit for a business account. It is usually split between Business Credit Cards and the LOC.

RBC Business Line of Credit

I'm not personally to fan of RBC, but it is still one of the biggest banks in Canada. You can take a look at their Business Loans landing page for further information.

For other Financial Institutions:

For all institutions, the process is very similar: You first apply, run a credit check and then go through an interview process where you present your business idea, your current assets, and your project.

And How About Interest Rates?

I won't talk about these here today as I'll dedicate a completely separate article for it, but expect an average range of 5% - 10% interest rate on the business LOC.

What to Do Next?

Well, my first suggestion is that you begin evaluating your next steps:

Scope your MVP funding needs and come up with a clear estimate.

Describe your project as much as you can in a paper (or digitally)

Discuss it with your friends, colleagues and even here in the comments. We'll be more than happy to provide our feedback.

Bring it on to your financial institution. Simply set an appointment and don't be afraid to discuss your options with the bank.

And then, start it up! Good luck with your MVP and your venture!

Hashtags

#entrepreneurship #entrepreneurbooks #entrepreneur #bookstagram #inspiration #business #businessideas #selfhelpbooks #books #businessbooks #businessbook #businessdevelopment #startupbusiness #startupbook

Cashwave offers seamless payment solutions tailored for modern businesses. If you're looking to streamline transactions, getting a MERCHANT ACCOUNT through Cashwave is a smart move. It's secure, efficient, and designed to support your business growth